Taxes off paycheck

Make Your Payroll Effortless and Focus on What really Matters. Discover The Answers You Need Here.

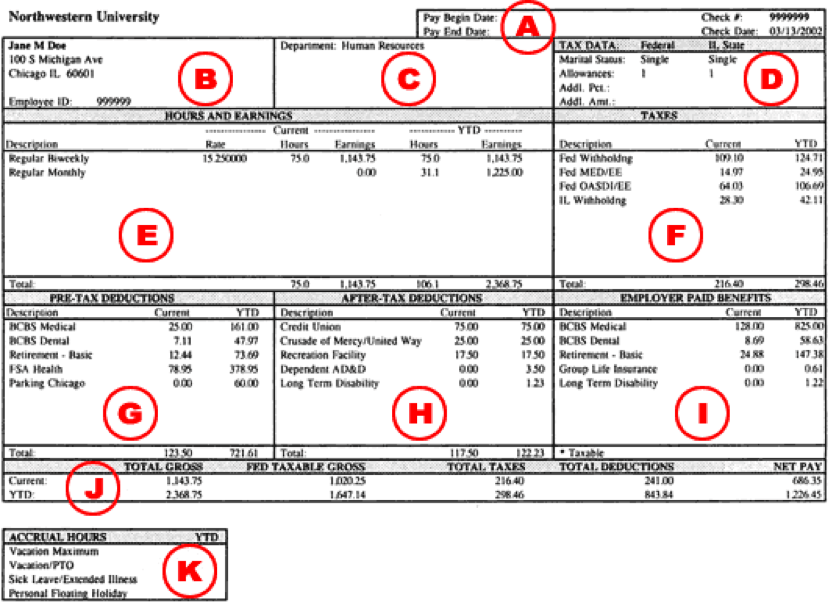

Understanding Your Paycheck Human Resources Northwestern University

The amounts taken out of your paycheck for social security and medicare are based on set rates.

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

. Combined the FICA tax rate is 153 of the employees wages. If you file taxes with a 1099 you must pay that additional 765 in taxes. The state tax year is also 12 months but it differs from state to state.

The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. The information you give your employer on Form W4. The amount you earn.

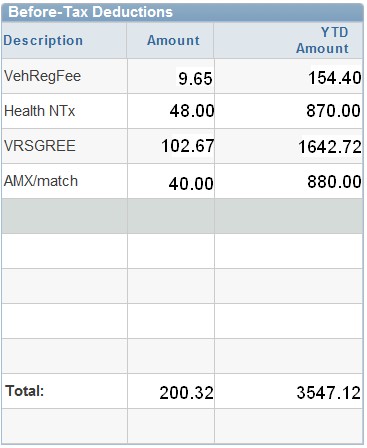

Im not sure if my check is right bc the of my taxes taken out dont align with federal rate or state my math may be wrong im not sure if im supposed to even pay some of them or if my pay and over time is right. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer.

New York Paycheck Quick Facts. Use this tool to. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10.

GetApp has the Tools you need to stay ahead of the competition. New York income tax rate. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

My pension is 87000 and Social Security is 27000 a year. Your new employer will use the information you provide on. Taxpayers can help determine the right amount of tax to withhold from their paychecks by doing a Paycheck Checkup now.

This is a significant deduction. There are seven federal tax brackets for the 2021 tax year. That means that your net pay will be 43041 per year or 3587 per month.

What is the percentage that is taken out of a paycheck. Start wNo Money Down 100 Back Guarantee. Withholding is the amount of income tax your employer pays on your behalf from your paycheck.

The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. Only the very. Some states follow the federal tax year some states start on July 01 and end on Jun 30.

Some deductions from your paycheck are made post-tax. For help with your withholding you may use the Tax Withholding Estimator. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Ad Read reviews on the premier Paycheck Tools in the industry. And so it goes through the various levels until the brackets top out at 37 539900 for single filers.

Only one payment your check is. You probably received a Form 1099-MISC instead of a W-2 to report your wages. The same goes for the next 30000 12.

Estimate your federal income tax withholding. One significant disadvantage of filing an extension is that you must wait longer for your tax refund than if you file on time. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

Census Bureau Number of cities that have local income taxes. Census Bureau Number of cities that have local income taxes. Ad Compare Prices Find the Best Rates for Payroll Services.

The percentage depends on your income. 10 12 22 24 32 35 and 37. If this is the case.

Youll need your most recent pay stubs and income tax return. Rate reg 20 hours 6460 ot 30 hours 465 tips cash. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

This marginal tax rate means that your immediate additional income will be taxed at this rate. For a single filer the first 9875 you earn is taxed at 10. How Your Washington Paycheck Works.

This comes to a total of 153 in payroll taxes. You can use the Tax Withholding Estimator to estimate your 2020 income tax. Get Started Today with 2 Months Free.

Get Your Quote Today with SurePayroll. These include Roth 401k contributions. Your average tax rate is 217 and your marginal tax rate is 360.

I have no dependents just myself and my check goes like this. Does the Social Security count as income. When you start a job in the Empire State you have to fill out a Form W-4.

These are the rates for taxes due. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Results are as accurate as the information you enter.

In fact your employer would not withhold any tax at all. If youre considered an independent contractor there would be no federal tax withheld from your pay. For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount.

All Services Backed by Tax Guarantee. Your bracket depends on your taxable income and filing status. However federal income and FICA Federal Insurance Contribution Act taxes are unavoidable no matter where you work.

Similar to the tax year federal income tax rates are different from each state. See how your refund take-home pay or tax due are affected by withholding amount. The changes to the tax law could affect your withholding.

Choose an estimated withholding amount that works for you. No Medicare or Social Security would have been withheld either. The payment for the earned income credit or noncustodial parent earned income credit is 25 of the amount of the credit you received for 2021.

Delay of your tax refund. The amount of income tax your employer withholds from your regular pay depends on two things. Of that total payroll tax the IRS allows you to deduct between 50 and 57 from your taxable income.

IR-2019-178 Get Ready for Taxes. How Your New York Paycheck Works. Cons of filing an income tax extension.

Federal income taxes are paid in tiers. With the 2019 tax code 62 of your income goes toward social security and 29 goes toward medicare tax but if youre employed by a company full-time they pay half of your medicare responsibilities so you should only see 145 taken from. Get ready today to file 2019 federal income tax returns.

Any income exceeding that amount will not be taxed. IR-2019-111 IRS reminds taxpayers to adjust tax withholding to pay the right tax amount. Self-Employment Tax Deduction.

Washington state does not impose a state income tax. Washington income tax rate. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021.

You pay the tax on only the first 147000 of your earnings in 2022. Ad Honest Fast Help - A BBB Rated.

Filing Taxes With Your Last Pay Stub H R Block

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Here S How Much Money You Take Home From A 75 000 Salary

Understanding Your Paycheck

Understanding Your Paycheck Credit Com

Here S How Much Money You Take Home From A 75 000 Salary

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Check Your Paycheck News Congressman Daniel Webster

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

Understanding Your Paycheck Direct Deposit Advice Jmu

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Taxes Federal State Local Withholding H R Block

Understanding Your Paycheck Youtube

Paycheck Calculator Online For Per Pay Period Create W 4